All Categories

Featured

In 2020, an approximated 13.6 million U.S. houses are certified capitalists. These households control massive wide range, estimated at over $73 trillion, which represents over 76% of all personal riches in the U.S. These capitalists get involved in investment possibilities usually not available to non-accredited capitalists, such as financial investments in exclusive firms and offerings by specific hedge funds, private equity funds, and equity capital funds, which permit them to expand their riches.

Keep reading for information concerning the most recent accredited financier alterations. Funding is the fuel that runs the financial engine of any kind of nation. Financial institutions generally fund the bulk, however rarely all, of the capital called for of any acquisition. There are circumstances like startups, where financial institutions don't give any kind of financing at all, as they are unverified and considered dangerous, yet the need for resources stays.

There are mostly 2 guidelines that permit issuers of securities to use unrestricted amounts of safeties to capitalists. non accredited investor platforms. One of them is Rule 506(b) of Policy D, which allows a provider to market protections to unlimited recognized financiers and approximately 35 Advanced Financiers only if the offering is NOT made via basic solicitation and basic advertising and marketing

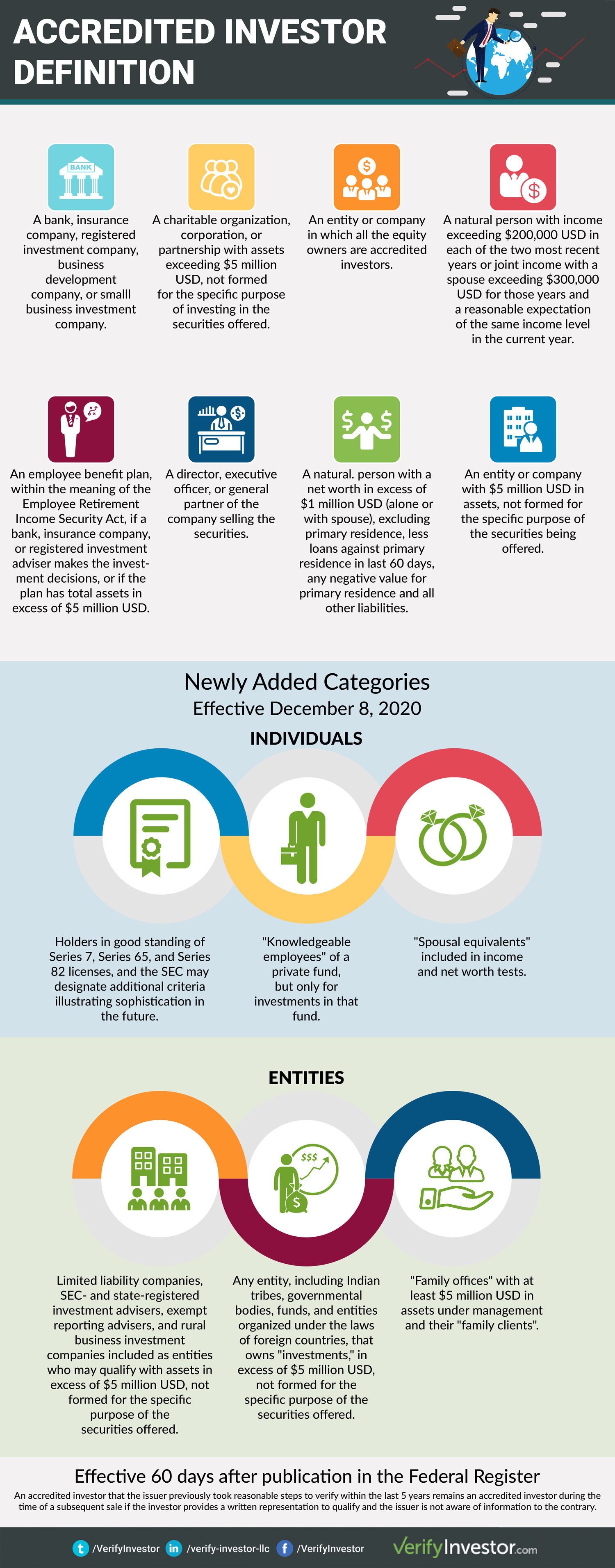

The recently embraced amendments for the very first time accredit private financiers based on economic elegance needs. The amendments to the accredited investor meaning in Rule 501(a): consist of as recognized financiers any trust fund, with total properties a lot more than $5 million, not developed specifically to purchase the subject protections, whose purchase is guided by an advanced individual, or consist of as accredited investors any entity in which all the equity owners are recognized investors.

And since you recognize what it indicates, see 4 Real Estate Advertising approaches to bring in accredited capitalists. Website DQYDJ PostInvestor.govSEC Suggested modifications to definition of Accredited FinancierSEC modernizes the Accredited Investor Interpretation. There are a number of enrollment exemptions that inevitably increase the universe of prospective investors. Lots of exemptions call for that the financial investment offering be made just to individuals that are accredited capitalists (accredited investor us requirements).

In addition, accredited investors often receive more positive terms and greater prospective returns than what is offered to the public. This is because private positionings and hedge funds are not needed to follow the exact same regulative needs as public offerings, enabling even more versatility in regards to financial investment strategies and possible returns.

Accredited Investor Investment Opportunities

One reason these security offerings are restricted to approved financiers is to ensure that all participating capitalists are monetarily advanced and able to fend for themselves or sustain the threat of loss, thus providing unnecessary the protections that come from a registered offering.

The web worth test is relatively easy. Either you have a million bucks, or you do not. On the earnings examination, the individual has to satisfy the limits for the three years continually either alone or with a partner, and can not, for example, satisfy one year based on specific earnings and the following 2 years based on joint revenue with a partner.

Latest Posts

Government Tax Lien Properties For Sale

If I Pay Someone Delinquent Property Taxes

What Are Tax Foreclosures